Student Loan Repayment Options – During the COVID-19 emergency, the US government took steps to help students by suspending federal student loan payments and fixing interest rates.

To help students effectively navigate this transition, the U.S. Department of Education (DOE) has provided a variety of options and resources. We strongly encourage students to request modifications that will help them manage their loans after the payment holiday ends. It is important to emphasize that if their circumstances change, they will have the flexibility to make a different choice later

Contents

- Student Loan Repayment Options

- What Are Your Student Loan Repayment Options?

- Loan Repayment Options

- The Saving On A Valuable Education (save) Plan Offers Lower Monthly Loan Payments

- Save Student Loan Plan Can Reduce Your Payments To What You Can Afford

- Federal Student Loan Repayment: Info & Resources

- Camilleri Urges Mde To Open More Application Periods For Student Loan Relief Grants

- Your Student Loan Repayment Options

- What Are Your Federal Student Loan Repayment Options?

- Business Concept Meaning Student Loan Repayment Options With Sign On The Piece Of Paper Stock Image

Student Loan Repayment Options

Students should promptly update their contact information with their loan servicer and at studentaid.gov This ensures that they receive all the necessary communications and prevents them from missing out on important updates

What Are Your Student Loan Repayment Options?

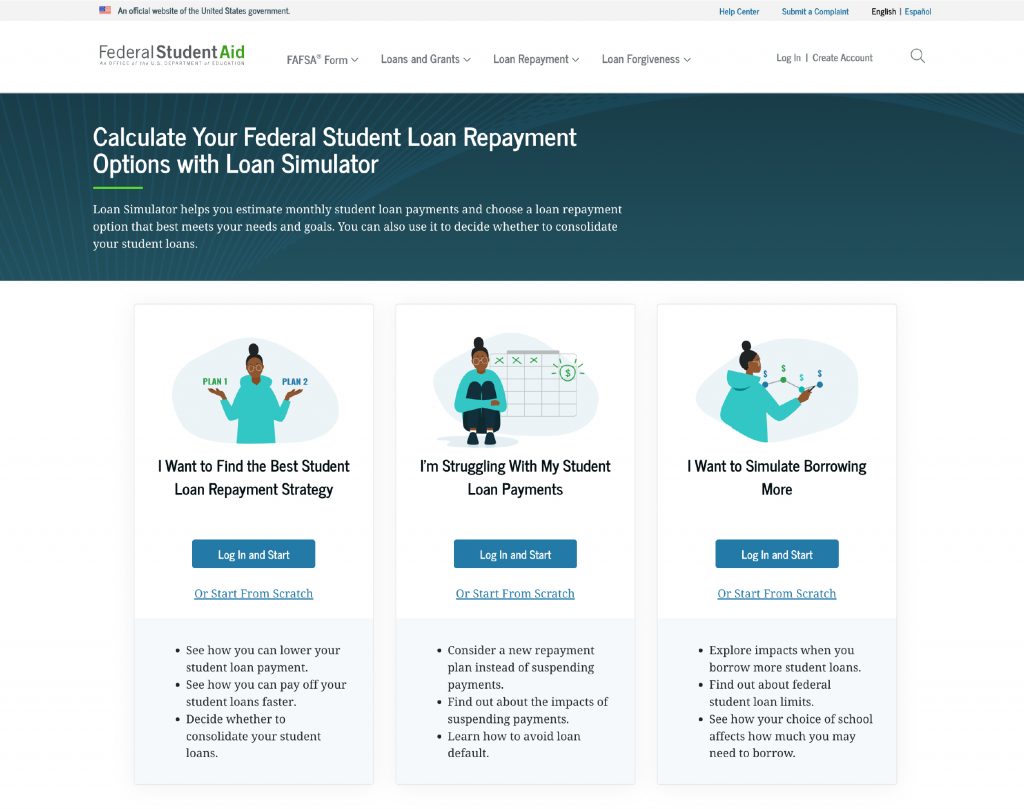

Students should evaluate their repayment plan options If they expect to need lower payments, they can visit the Federal Student Aid (FSA) loan simulator to explore repayment plans that fit their needs and goals. Moreover, they may consider loan consolidation after carefully weighing the pros and cons

Students facing financial challenges should explore income-driven repayment (IDR) plans These plans may be able to reduce their monthly payments to $0 depending on their circumstances New this year is the Savings on an Affordable Education (SAVE) IDR plan, which offers student loan borrowers the most affordable repayment plan yet. The SAVE plan will cut student loan payments in half compared to other IDR plans and protect a larger portion of a borrower’s income for basic needs.

Students should check their Direct Debit enrollment status or consider signing up for Direct Debit. By signing up for direct debit, direct borrowers can get a 0.25% interest discount on their loans. Are you still paying off your student loans? You may be eligible for student loan forgiveness through the Public Service Loan Forgiveness Program

Student loans are issued without considering the long-term impact of compounding interest on college loans and how it may affect their financial well-being over time. Fortunately for millions of Americans, the federal government offers a public service loan forgiveness program for employees:

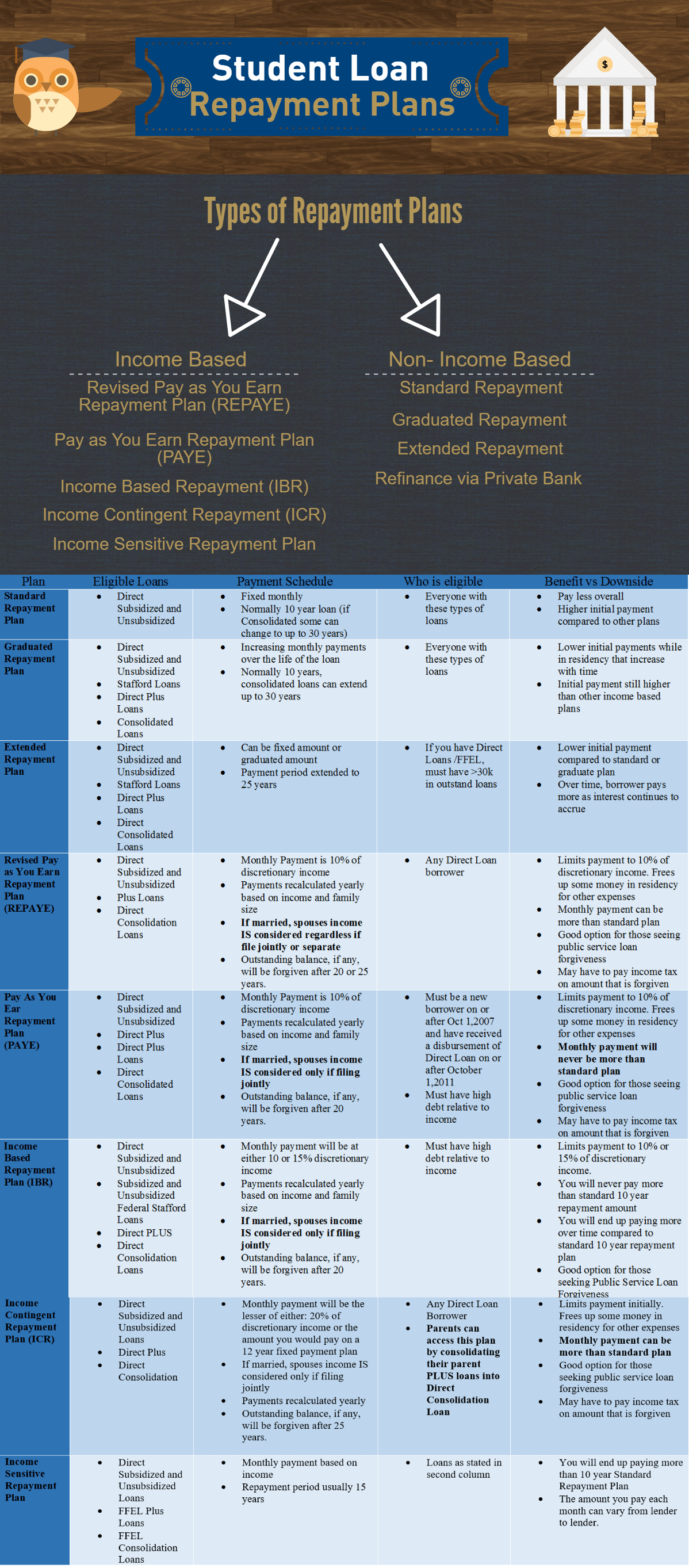

Loan Repayment Options

It is very important for you to find a plan for forgiveness Students are eligible for forgiveness under any repayment plan the government offers, but it’s important to find the best program for you The three most common repayment plans are: an income-based repayment plan, an income-based repayment plan and a pay-as-you-go repayment plan.

A borrower from an eligible lender can apply for loan forgiveness Websites such as Studentaid.ed.gov and Myfedloan.org provide an overview of eligibility requirements

Federal loans are financed by the federal government, while private loans are provided by a lender such as a bank, credit union, government agency, or school. A detailed list of similarities and differences can be found at Studentaid.ed.gov

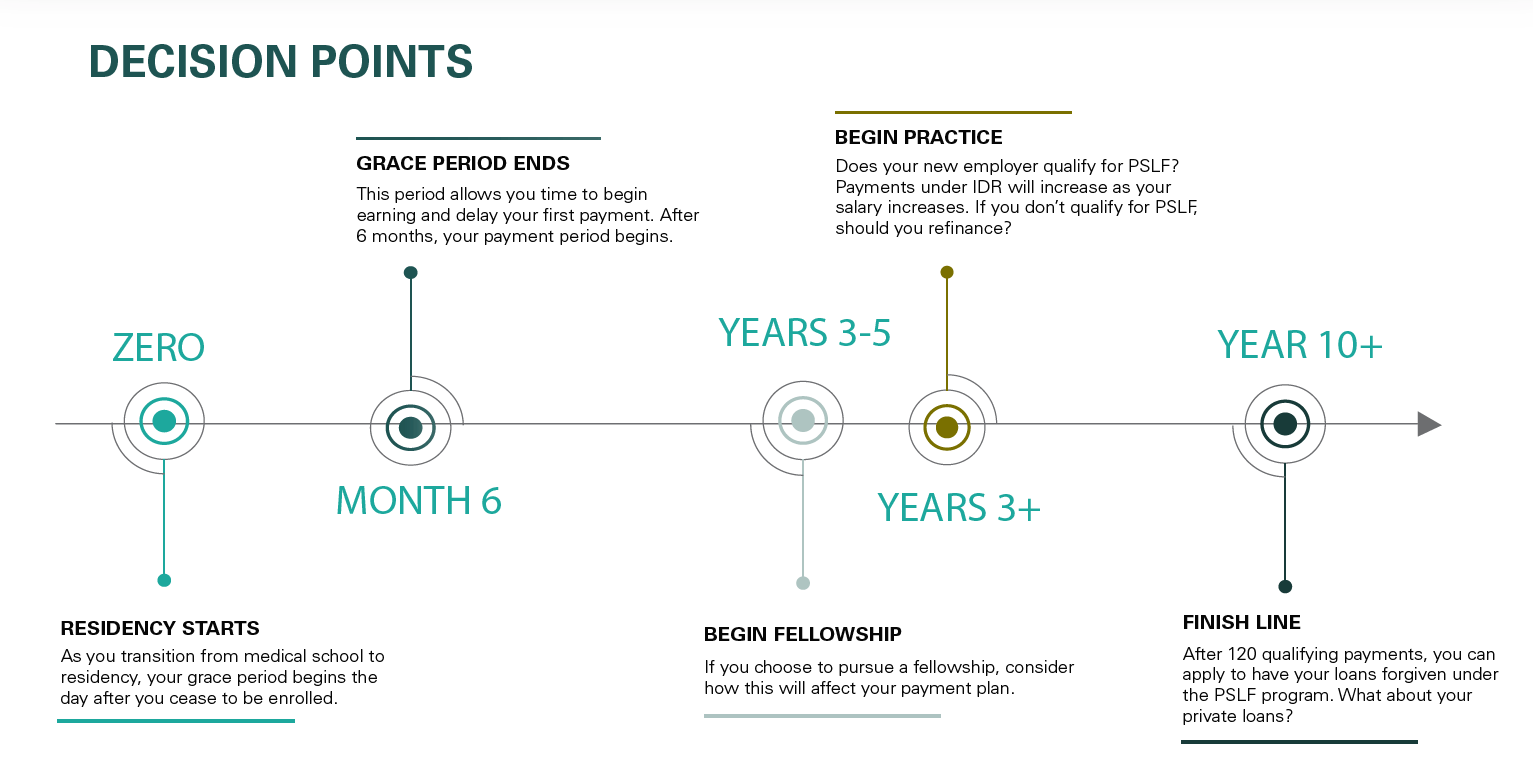

If you are in government service, it does not mean that your loan will be forgiven at once However, to qualify for this scheme, you have to make 120 loan payments on time It is also mandatory that you are employed by a non-profit or government organization during all these payments The best student loan repayment plan is the one that works for you, your goals and your financial situation To know your best option, do your research and consider the pros and cons of each plan (Note: Also consider whether the monthly payment is affordable and how much interest you’ll pay over the life of the loan.) Then sign up for the plan that makes the most sense for you. The good news is that the federal government offers borrowers a lot of flexibility and you can change your repayment plan at any time. There are four types of federal student loan repayment plans Most borrowers stick with the standard 10-year repayment plan or opt for an income-driven repayment plan. Although less common, graduated repayment plans or extended repayment plans offer a smart option for some borrowers.

The Saving On A Valuable Education (save) Plan Offers Lower Monthly Loan Payments

Repayment plans are not one-size-fits-all To figure out which one is best for you, consider your annual income, how much debt you have, the size of your family and your current financial situation.

Knowing the key differences, benefits and financial implications of each federal student loan repayment program can help you make a choice that best suits your situation.

There are four types of repayment options for federal loans Before getting into the details of each plan, here’s a quick summary:

It depends on your financial situation and your ultimate goal Which of the following do you most identify with:

Save Student Loan Plan Can Reduce Your Payments To What You Can Afford

Visit the section to learn more about your best options We will see the pros and cons of different plans later

If you’re trying to get the lowest possible monthly payment, you have two options, depending on your income

Most borrowers find themselves in the first situation: They can’t afford to pay what they need under a standard repayment plan because they don’t earn much.

If your main goal is to pay off your loans quickly so that you don’t have to pay a lot of extra money on interest, stick to the standard repayment plan. The SRP has the shortest repayment period of all federal repayment plans: 10 years

Federal Student Loan Repayment: Info & Resources

If you’re truly committed to tackling your student debt and you can afford it, pay more toward your principal balance each month or put some “free” money toward your principal. For example, some people use all or part of their state or federal income tax refund to make additional payments on student loans.

PSLF is the most popular forgiveness program and unfortunately, it is also one of the most difficult for borrowers. To qualify for Public Service Loan Forgiveness (PSLF), you must be enrolled in an income-driven repayment plan. You must also work for a qualified employer Learn more in our ultimate guide to PSLF

This is a great service…I would recommend it to anyone who needs to file bankruptcy but can’t afford an attorney

After you graduate or leave school, you are given a six-month grace period in which you do not have to make any student loan payments. After that, federal student loans automatically fall into the standard repayment plan unless you choose a different payment plan.

Camilleri Urges Mde To Open More Application Periods For Student Loan Relief Grants

The standard repayment plan requires you to make fixed monthly payments for 10 years Every borrower is eligible for SRP and you do not need to apply for this plan unless you have changed your repayment plan and wish to re-enter SRP.

The main benefit of SRP is that you repay the loan within 10 years and you pay the lowest interest of any scheme. Another benefit: Your loans are automatically included in the standard repayment plan after graduation, so you don’t have to make any extra effort to change your plan.

The main disadvantage of SRP is that you will have the highest monthly payment of any repayment plan It might not be a problem if you can afford it! But if you can’t afford it, you run the risk of missing out or falling behind on payments, which has serious consequences (fortunately, you can apply for a new plan or request a deferment or deferment if you can’t afford the SRP payments).

All borrowers are eligible for graduated repayment plans As with standard repayment plans, your monthly student loan payments will increase over time Your monthly payments start low and then increase every two years This payment plan ensures that your federal student loans are paid off within 10 years, or between 10 and 30 years for consolidated loans.

Your Student Loan Repayment Options

Unlike the Standard Repayment Plan, it is not ideal for those seeking public service loan forgiveness because it is generally not a qualifying repayment plan for PSLF.

While the monthly payments are lower here, the borrower will pay more over the life of the loan due to higher interest rates in the initial years.

* If you are a Direct borrower, you must have more than $30,000 in outstanding Direct loans to qualify for the extended repayment plan.

Under this plan, your federal student loan monthly payments will be lower than under both the Standard and Graduate Repayment Plans. However, if the loans are repaid over 25 years, you will pay more over the life of the loan

What Are Your Federal Student Loan Repayment Options?

Borrowers can choose to make fixed monthly payments (so the payment amount stays the same over the 25-year term). Or borrowers can choose to start with a lower monthly payment at the beginning of the repayment plan, which increases as the loan progresses.

Although there are four different types of income-driven repayment plans, they all have certain things in common:

To qualify for an income-driven repayment plan, you must have a high debt load relative to your income. Your monthly payment is 10% or 15% of your discretionary income, depending on when you first take out the loan. Your repayment period is 20 or 25 years, again depending on when you took out your first federal student loans.

If you have a direct loan (subsidized or

Business Concept Meaning Student Loan Repayment Options With Sign On The Piece Of Paper Stock Image

Student loan repayment options calculator, alternative student loan repayment options, student loan repayment program, discover student loan repayment options, best student loan repayment options, private student loan repayment options, student loan options for repayment, private student loan repayment, student loan repayment, student loan repayment options explained, student loan repayment plan options, new student loan repayment options